Price discovery

In financial markets, prices are often (implicitly) regarded as the product of some autonomous process that continuously adapts for developments in factors that impact supply and demand, including future supply and demand. This process determines the correct value of every financial instrument. And on top of that, there is the market impact of trading activity — either disruptive or corrective. Decently executed transactions — which most of us of course strive for — supposedly have no market impact; they are neatly executed at the fair price. According to this market model, the price of Apple stocks for instance rises when the company publishes better than expected demand for its newest iPhone.

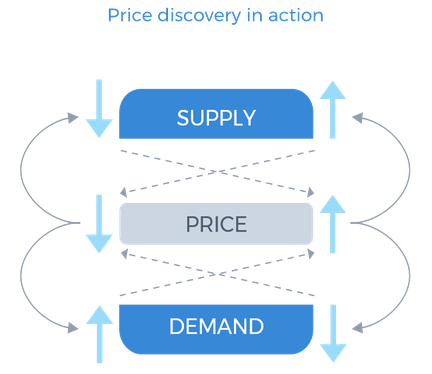

The reality is, such an autonomous process does not exist. It is the role of markets to facilitate price discovery, i.e., the process of determining the ‘economically fair’ price for goods, services and financial instruments. And the activity of buyers and sellers is key in this process. The only reason why Apple’s stock price rises is because buyers are expressing a willingness to pay more than they did before and/or sellers are not willing to sell for less. This may be because of newly published positive demand projections. But the price impact is exactly the same if buyers buy just as aggressively for a different reason. Also when that reason has nothing to do with Apple. In a free and open market, the market impact of buyers and sellers is the one and only force that makes markets move. It is the gravity of the market.

In a free and open market, the market impact of buyers and sellers is the one and only force that makes markets move. It is the gravity of the market.

To make this process work, it has to be transparent and open for all potential buyers and sellers. It is for this reason that already in Roman times, major cities organized regular fairs or markets where people from the surrounding areas could meet to negotiate a fair price for the goods they brought or wanted, ranging from fish, pigs and cheese to textiles and crockery. These physical meetings on a central marketplace may by now have been replaced by electronic ‘gatherings’, but this has not changed their core functioning. There is no market without market participants. And no market participant — surely not a professional investor — has a ‘right’ to buy or sell against a fair price. Instead, it is their (and therefore also our) responsibility to negotiate fair prices.

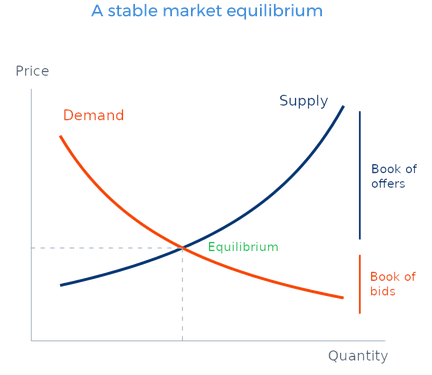

According to traditional micro-economics, in a competitive market the equilibrium price for a good is the level where supply meets demand. At the basis of this theory is a supply curve that increases with price and a demand curve that decreases with price. The equilibrium is found where these two curves intercept.

A necessary condition for such an equilibrium is that not all orders sent to the market will be filled. A stable equilibrium requires a sizable book of offers resting above the equilibrium price and a sizable book of bids resting below the equilibrium price. In other words, it requires market participants that are actually expressing a downward sloping demand curve and an upward sloping supply curve. These could for instance be active investors that are not willing to sell at the current price, but would be willing to sell at a higher price. Even if that would result in not selling at all, or at least not on that particular day. Such investors effectively transmit price-sensitive orders into the order book.

Price-insensitive orders, on the other hand, are defined as orders that have to be executed irrespective of price. Popular examples are orders that are executed in an electronic order book by applying a VWAP (volume-weighted average price) or TWAP (time-weighted average price) strategy. Market participants sending price-insensitive orders to an order book are essentially expressing a vertical demand curve (when buying) or a vertical supply curve (when selling). An important characteristic of vertical curves: they do not cross! If all orders would be price-insensitive, no equilibrium would be reached. Too many price-insensitive orders make the market price highly sensitive to additional demand or additional supply and will inevitably lead to sudden price swings.

The role of futures contracts

It will be clear from the above that price discovery is not only about determining a fair price. It is a balancing act between three variables: price, supply and demand. The faster supply and demand adapt to price, the more stable the market. In financial markets this should not really be a challenge — stocks, bonds, currencies and futures contracts are not perishable products like fresh fish and fruit, which means that potential sellers can delay their supply when they find current prices too low without their ‘products’ losing value. (Of course, they then run the risk of prices declining further, but this is a different mechanism where the sellers play a leading role.)

In the real economy, it generally takes time for supply and demand to adapt. For instance, factories will have to add production lines and/or hire more people to increase their future supply. Farmers, once they have seeded their crops, cannot do very much to increase their yield — additional irrigation, fertilization or pest control, that’s about it. They will have to wait until the next sowing season before they can plant the crop that actually seems more in demand. And it typically takes two years to increase the cattle herd in dairy farms. The demand side faces comparable challenges. For instance, once an airline has sold its tickets, it has no alternative but to buy the required kerosene to fly its planes, irrespective of the kerosene price at that moment. And a battery producer that uses a lot of nickel cannot immediately switch to another type of battery when the nickel price becomes uneconomical.

To overcome these timing issues, futures contracts have proven themselves to be the ideal instrument. Market participants that use futures contracts essentially have time on their side. For instance, when the planting season approaches, farmers take the expected prices at harvest of the various crops into account when deciding which crops to plant. In this process, the prices of the various futures contracts serve as important indicators.

So price discovery with respect to futures contracts is not only about the price, supply and demand at the moment a contract is traded, but above all about the price, supply and demand of the underlying value at the moment of delivery. With time on our side, this balancing act can take place efficiently across all three variables. There will still be time to respond to rising prices of futures contracts by increasing the future supply and/or reducing the future demand, which typically means less shortage in the underlying market in the future.

Price discovery with respect to futures contracts is not only about the price, supply and demand at the moment a contract is traded, but above all about the price, supply and demand of the underlying value at the moment of delivery.

When futures prices — especially those of commodity futures — reach high levels, speculators that are supposedly buying these contracts are often criticized for escalating the cost of living. However, when shortage looms, prices of futures contracts should rise in time and should rise enough to give producers an incentive to raise their production and consumers an incentive to find alternatives. When this process functions well, the cash price at delivery will in fact be lower than it would have been without these signals from the futures markets. Without such interaction, markets would swing wildly from over-supply to over-demand.

There is one caveat, though. The stock price of a company like Apple should rise if the goods or services that it produces are in demand. And if they are not, it should not rise. With respect to commodity futures, this mechanism is even more critical. If investors buy futures contracts when they believe shortage looms, they contribute to well-functioning markets. But what if investors buy futures contracts for another reason irrespective of price, for instance to implement a ‘passive’ long-only commodity investment mandate? Such buying has the exact same signaling effect. But in this case it is sending false signals, which fundamentally undermines the functioning and the stability of the underlying market.

Futures on agricultural commodities are the oldest futures contracts in the world, having existed for more than a century. They have proven themselves to be an invaluable part of a stable food chain. We believe that apart from hedgers, speculators have always played a key role in this success. But these speculators have to be active traders — traders that buy when they consider prices too low and sell when they consider prices too high. In fact, these speculators often fulfill a larger role on the short side than on the long side.

This text is an excerpt from Transtrend’s Responsible Investing policy, which sets out Transtrend’s position in society and our environment. It can be downloaded here.

Get in touch with us

Heeregrave

van Eijck-Dossin

Tolenaar