Performance update

-

DTP - Enhanced Risk (USD) Composite

Inception date:

01 Jan 1995 -

19 Dec 2024

-1.45%

MONTH TO DATE

3.37%

-

MONTH TO DATE

3.37%

-

YEAR TO DATE

7.77%

INCEPTION TO DATE

10.69% p/a

-

INCEPTION TO DATE

10.69% p/a

This data should be viewed in conjunction with the explanatory notes, which are an integral part of this performance data. The full track record of DTP can be found below. THE VALUE OF YOUR INVESTMENT CAN FLUCTUATE. PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS.

Diversified Trend Program

-

Systematic trend-based trading strategy

-

Active and adaptive

-

Attuned to the major developments in the world

Program overview

Our Diversified Trend Program (DTP) is a trend-based managed futures program that has been trading live since 1992. The objective of DTP is to generate attractive returns with a low correlation to traditional asset classes. It aims to achieve absolute returns and does not follow any benchmark or index. The program trades globally in futures, forwards, and swap markets on a wide variety of underlying assets and is designed to participate in the underlying trends that drive these markets.

Most price trends in markets are a reflection of broader trends and developments in our continuously evolving world. Each development — such as an increased impact of extreme weather, negligence of agricultural production, economic growth in China, a shift in political sentiment, or an embrace of AI — is typically reflected in price trends in a number of different markets. In our approach, such a development represents just a single trend. With DTP, we aim to be sizably positioned in as many of these trends as possible. This requires trading a wide variety of markets, including alternative markets and combinations of markets. We select and construct these markets as our vehicles to ride the underlying trends.

Our focus on the fundamental factors that truly drive markets has significant implications for DTP's portfolio construction and risk management processes. Even though we show in our client reports how the risks are currently distributed across the different asset classes, these asset classes play no role in determining our position sizes. The real factors that drive markets typically exceed such artificial boundaries. With DTP, we strive for a balanced risk allocation across these real underlying factors.

The world continuously changes. And our markets continuously change. It’s these developments that drive us and our trading program.

A strong feature of DTP is its demonstrated ability to perform well during crisis periods, especially those accompanied by extended stock market declines. Our clients appreciate this — it makes DTP a valuable addition to their investment portfolios. But this feature does not come automatically with the program’s investment style. It is the result of many deliberate choices we make — choices that are at the very heart of our investment process.

Also central to our approach is the acknowledgement that we must continue developing and adjusting all components of DTP to stay in sync with the markets. New markets emerge, others fade. And the ongoing modernization of market platforms and shifts in behavior of their participants continuously and fundamentally change market dynamics. Such developments cannot be ignored. We believe that no trading strategy can be used for more than a few years without significant adaptations. An evolving world requires an evolving approach: the 30+ years track record of DTP is the result of that.

Broad access to trends

DTP’s investment universe consists of more than 500 commodity and financial markets, providing broad access to trends via a combination of mainstream and alternative markets.

Uncorrelated absolute returns

DTP has a 30+ years track record of providing attractive absolute returns with low correlation to the major asset classes.

Crisis performance

DTP has a demonstrated ability to perform well in times of crisis, such as the Dot-com Collapse (2001-2002), the Credit Crisis (2007-2008) and the Covid-19 pandemic.

Select a period in the graph below to learn more.

The DTP returns represent composite performance figures of the Enhanced Risk (USD) subset of DTP. This data should be viewed in conjunction with the explanatory notes, which are an integral part of this performance data, and the description of indices used. Equities are represented by the MSCI DM World Index (Net/Local Currency), Bonds are represented by the Bloomberg Barclays Capital U.S. Aggregate Bond Index, Commodities are represented by the S&P GSCI Total Return (USD), Managed Futures are represented by the Barclay BTOP50 Index, Hedge Funds are represented by the Credit Suisse Hedge Fund Index and Trend Following is represented by the SG Trend Index. Source of all data used in the chart and table: Refinitiv, Bloomberg, BarclayHedge and Transtrend. THE VALUE OF YOUR INVESTMENT CAN FLUCTUATE. PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS.

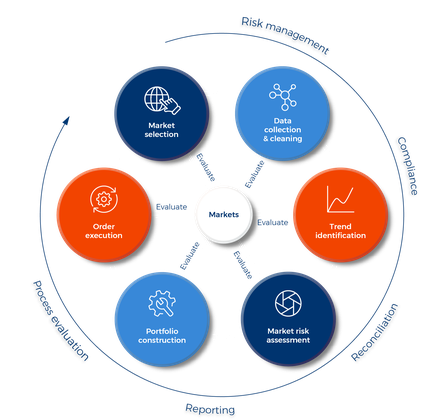

Trading process

All elements of our Diversified Trend Program are tightly interconnected and together form one coherent operation:

Core principles

Our trading process is based on the following principles:

People in control

Though DTP is a systematic trading strategy, it is ultimately powered by the people behind it

Adaptive

We keep DTP in sync with the markets through continuous evaluation and improvement.

Responsible

We aim to contribute to well-functioning, well-organized and reliable markets.

Recent awards

More information on the awards is available here.

THE VALUE OF YOUR INVESTMENT CAN FLUCTUATE. PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS.

How to invest

Our Diversified Trend Program is offered through various investment vehicles and formats, each tailored to meet specific client needs.

Funds

A variety of commingled funds, including a SICAV and a UCITS, provide access to DTP, offering options in risk profiles and currencies.

Easy & direct access to DTP with a relatively low minimum investment.

Managed accounts

Managed accounts can be tailored to specific client preferences, allowing customization of aspects such as liquidity, funding, investor restrictions and reporting.

Control and cash efficiency with a relatively high minimum investment and more operational complexity.

Other solutions

DTP is also accessible through other solutions, including platforms and structured products like delta-one swaps or capital-guaranteed notes.

Tailored to more specific client needs with the help of additional third parties.

For more information on these investment options, please contact our Investor Relations team.

Get in touch with us

van Loo

Honig

Tolenaar